Like its namesake from ancient Greek history, a Trojan Horse presents itself in a harmless form, lulling its victims into a sense of false security.

The original malware miscreant, it is a decoy, ushering in malicious software that can often go undetected.

Do Trojan Horses attack personal computers?

As long as you have information that is of interest to the cybercriminal, you are at risk of coming under an attack. This information could be passwords to your online bank account or your PayPal account, for example. Remember, this Trojan Horse is out there doing the same thing to millions of other personal computer users, making this one of the most lucrative cybercrimes.

Trojans survive by escaping detection, sitting silently in your system garnering information and setting up holes in your security.

What does a Trojan Horse do?

- Spies. They are designed to lurk behind the scenes waiting until you access your online bank accounts or pay for online using your debit or credit card. It will then send your passwords and other relevant data to its master.

- Creates backdoors. It often arrives on your cyber doorstep and compromises your system’s security so that other hackers or malware operators can enter.

- Zombifies. Sometimes the cybercriminal is not interested in you at all. It just wants to act as a parasite and turn your device into a slave in a network that they have under their control.

Is it only computers that are at risk?

Unfortunately, mobile telephones are also under attack from Trojans. The most common method is making your mobile send costly text messages to premium numbers. This is something which is totally out of your control and quite unlike the other way cyber crooks dupe us into making expensive calls to numbers that they own.

Here is a Trojan Horse check list:

Installed programmes

Go to the add/remove feature on your PC or Finder Feature on your Mac to see if there are programmes you don’t recognise. If so, it means you have a Trojan Horse or a legitimate download added a programme behind your back. Either way, it is good to remove it.

Start Up Software

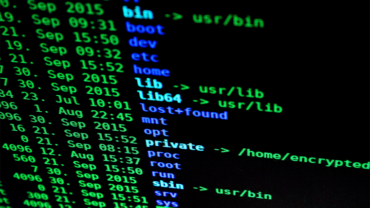

Not all Trojan Horses will be in the add/remove program list. For a more comprehensive list on Windows, for example, hold the windows key and press R to bring up the run menu. From that menu, type “regedit” and click enter. It will show you all the software installed. If you aren’t sure of some of the software that pops up, then do a search for them online to see if they are the real deal or not. If not, delete them.

Performance

If your computer is running slowly, use the Ctrl-Alt-Del command to pull up your task manager. Click on the processes tab to see what programmes are using up your memory. If you notice a programme you don’t recognise search its name online to see if it is a Trojan Horse.

Invest in an antivirus

This should be something you invested in from the get-go, but if not, then you should waste no time in investing in a strong reliable antivirus. This precaution is the best way to identify malware.